Employees Provident Fund is a welfare policy brought into play through the Employees Provident Fund and Miscellaneous Provisions Act. Here, a system was brought into place whereby the employer and the employee contribute amounts to the provident fund of the employee.

The amount to be contributed from the employee shall be deducted from his/her salary. On retirement, the said amount accumulated, along with interest on the amount shall be given to the employee.

The Framework

The framework for Employees Provident Fund Scheme has been devised under the Act. The statute extends to all of India except Jammu and Kashmir. This applies to every establishment or factory specified in Schedule I of the act and the establishment or factory in which twenty or more people are employed.

It is also applicable to establishment that has twenty or more employees, which the Central Government has notified through the official gazette. Notwithstanding the above-mentioned criteria, the act could be made applicable to any other establishment by the Central Provident Fund Commissioner.

The basic working principle of the act is mutual contribution by employer and employee along with interest paid by the Employees Provident Fund Organisation to be paid to the employee on his retirement. Also, the act has provisions for establishment of Employees Provident Fund Tribunals to exercise the powers and discharge functions as conferred by this act..

Nonetheless, it is pertinent to note that the act doesn’t apply to specified government establishments with alternative retirement welfare schemes or cooperative societies.

PF Contribution Calculation

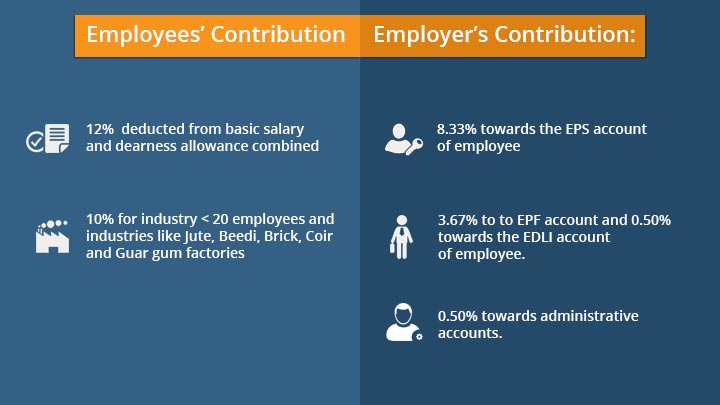

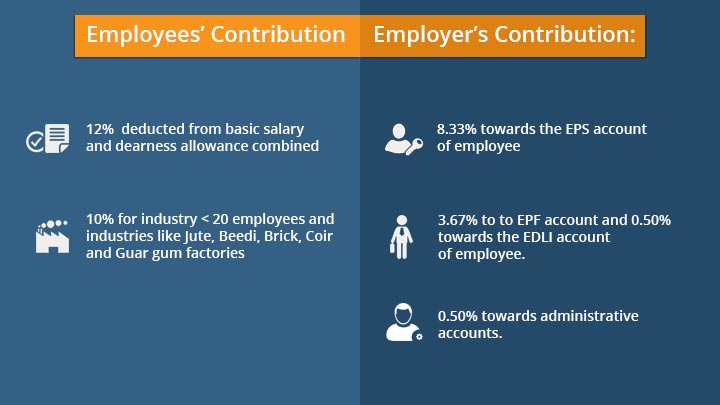

As per the provisions of the statute, the contributions come in two parts, that is, employer contribution and employee contribution.

-

Employees’ Contribution: This contribution is deducted from the basic salary and dearness allowance combined. 12% of this amount is normally deducted for the purpose of EPF. For an industry that has less than 20 employees, and for industries such as Jute, Beedi, Brick, Coir and Guar gum Factories, the contribution is 10 %.

-

Employer’s Contribution: The employer too makes more or less similar contribution to each employee’s provident fund. The employer contributes 8.33% towards the EPS (Employees’ Pension Scheme) account of the employee. Another 3.67% is added to the EPF account of the employee and a 0.50% towards the EDLI (Employees’ Deposit Linked Insurance) account of the employee. From July 2018 onwards, the employer is supposed to pay 0.50% towards administrative accounts.

How the Interest Rates are calculated:

The interest rates on the Employees Provident Fund Scheme are determined from time to time by the Employees Provident Fund Organisation, which has to get approval from the Ministry of Finance.

In April 2019, the Finance Ministry approved the 8.65 percent rate of interest on the Employees’ Provident Fund (EPF) for 2018-19, as decided by the retirement fund body EPFO, working under the Ministry of Labour and Employment, benefiting more than 6 Crore formal sector workers. The interest contribution rate for 2016 – 17 was 8.65% and in the subsequent year, 2017 – 18 was 8.55%.

However, at this juncture, it is pertinent to note that it is not compulsory for every employee to contribute to the Employees Provident fund. The scheme has a wage ceiling of 15000 rupees; this initially used to be 6500 rupees, but the Ministry of Labour and Employment has increased Employee Provident Fund (EPF) Limit to Rs. 15,000 vide a notification in the year 2014.

Employees having basic salary of more than 15,000 have an option to opt out of PF at the time of joining the company.

Universal Account Number

This is a system to organise the Pension Fund Scheme in a way which minimises logistical hassles. Hence, each employee is given a Universal Account Number by the EPFO. The idea is to link multiple Member Identification Numbers (Member Id) allotted to a single member under single Universal Account Number.

This account number allotted to an employee will remain the same throughout his/her career. Hence, even if you are switching establishments in the course of your career, the new employer could continue the EPF contribution to the same Universal Account Number you hold. All you need to do is submit the Universal Account Number with basic details to the new employee in a Composite Declaration Form (F-11).

General Process of Withdrawal

As per the Act, to avail the final settlement of EPF, the employee has to be at least 58 years old at the time of retirement. Here, the total EPF contributions by the employee and the employer along with the interest accrued could be claimed by the employee. In addition to the same, the Employees’ Pension Scheme contribution as well shall accrue to the employee depending on the years of service.

You need to fill and submit Form 10D to claim your full pension.

You cannot claim the EPS in case you are retiring before age 58. However, you can claim a reduced pension if you are between the ages 50-58 by filling Form 10D and the Composite Claim Form.

Both the EPF balance and the EPS amount will be paid to you if your service period is less than 10 years. To avail this, you need to check the option for ‘pension withdrawal’ in the Composite Claim Form.

Taxability of Employees Provident Fund

This can be divided into three segments:

-

Taxability at the time of investment: The employer’s contribution is liable for tax if it exceeds 12%; up to 12% of the contribution is tax-free. The employee’s contribution is tax-free up to a limit of Rs. 1,50,000 under Section 80C of the Income Tax Act. Hence, that could be seen as the maximum limit for EPF contributions if you wish to avoid taxes.

-

Taxability at the time of interest: Interest earned above 9.5% is taxable as ‘income from other sources’.

-

Taxability at the time of withdrawal: At the time of withdrawal if the continuous service period is more than 5 years, the employee’s contribution, the employer’s contribution and the entire interest amount is tax-free subject to the conditions on taxability at the time of investment and employment as mentioned above. In case the continuous service period is less than 5 years, the employee’s contribution is taxable if 80C is availed at the time of investment and tax-free if it is not availed at that point. Employer’s contribution and the interest amount too are taxable.

Written by: Jesse Jacob V

National University of Advanced Legal Studies, Kochi (3rd Year)